Harris, Reed & Seiferth

|

The votes have been counted and the results are in! Harris, Reed & Seiferth Insurance Group is a 2023 Best of Florida® Regional winner in Guide to Florida’s annual readers’ poll. Guide to Florida readers and editors have weighed in on the best of everything in Florida, honoring thousands of businesses and organizations in more than 25 broad business and community sectors. The process starts with a nomination on the Guide to Florida website. Voting remains open throughout the year, with tens of thousands of votes ultimately received. The process culminates with the publishing of the Best of Florida Keepsake Annual along with a statewide publicity campaign.  Best of Florida winners and nominees are chosen by a combination of readers’ votes and editors’ input, and are vetted through several ranking sites, Better Business Bureau complaint reports, and voting pattern analysis reports. Winners are named in hundreds of individual categories, providing Guide to Florida readers with a go-to-guide for the best of everything in Florida. Guide to Florida recognizes three levels of winners: The Best of Florida, Best of Florida Regional Winners and Honorable Mentions. Within each category, there are multiple honorees named in each tier, depending on the size of the market sector. You can view the full list of Best of Florida winners at GUIDEtoFLORIDA.com/best-of/

0 Comments

Do you own a boat and are you looking for insurance coverage but don't know where to start? If can seem overwhelming at first, and that's why it can be a good idea to seek advice from an insurance agent. We spoke with a marine product manager to gain some insight on boat insurance, and they recommend five important questions you may want to ask while shopping around.

1. Do I need insurance for my boat? "Some people may think that their boat is adequately covered through an endorsement on their homeowner's policy. Worse yet, they don't carry any coverage at all. Boat owners should look for a specialized insurance policy that offers the coverages that fit their boat and lifestyle. It's better to be prepared and have it insured for peace of mind while on the water." 2. Will my personal property be covered? "Buying life vests, water skis and fishing gear can really add up. A good policy will not only provide coverage for all of this equipment, but also for other personal property on board." 3. What discounts are available? "There's a variety of discounts a customer could qualify for, like a multi-policy discount if they insure more than just a boat with the same company, or a multi-unit discount if they insure more than one boat. Discounts will help a customer save money on the policy's premium." 4. Is towing and roadside assistance available? "A day of fun in the sun could easily be ruined if the boat breaks down while on the water. This is a great coverage to add to a policy and covers either the cost of certain emergency fixes at the point where the boat broke down, or the cost of towing the boat to nearest repair shop. Towing and assistance should also apply to the trailer if it breaks down while towing the boat." 5. Is the type of boat I have eligible for insurance coverage? "There are many different kinds of boats — pontoons, open bow, fishing boats, cabin cruisers—and even more things to consider like speed, length, value and use of the vessels. That's why it's important to make sure your agent knows all these things up front, even how you will use your boat. Your agent can help you get the insurance coverages that are just the right fit." Looking for boat insurance? Get a quote today by clicking here. Source: https://www.foremost.com/learning-center/five-questions-to-ask-about-boat-insurance.asp  Hurricanes. Just the thought of them can make a person tremble in fear. Whether you've experienced a hurricane yourself or you've just heard about their destructive patterns, these bad boys know how to make their name heard. The technical definition of a hurricane is a tropical cyclone with maximum sustained winds of at least74 mph. A major hurricane is a tropical cyclone with maximum sustained winds of at least 111 mph. To put that into perspective, imagine sticking your head out the window of a car as you travel down the highway - that's the speed of wind you would be up against during a low-scale hurricane. Sound scary? It is. By knowing your vulnerability and what actions to take, you may be able to reduce the effects of a hurricane disaster. Hurricane season runs June 1 through November 30. Foremost wants to share some tips to ready your home and family prior to a severe storm, may it hit. It's never too early to:

Stay safe through these storm seasons! Your safety is number one to us. Source: https://www.foremost.com/learning-center/more-storms-to-come-during-hurricane-season.asp  What do outdoor adventures look like for you? Whether it's an ATV, UTV, dirt bike, dune buggy, golf cart or other off-road vehicle (ORV), you'll want to make sure you have the right type of insurance coverage to protect your toys. It's important to ask your independent insurance agent the right questions about what type of coverage you're seeking and customize it to fit your lifestyle. To help you get started, we put together the following list of questions after speaking with Kevin Henry, the Director of Product Management at Foremost® Insurance. 1. What typical coverages are available for ATV/UTVs? "Ask your agent or broker about standard coverages that are available, as well as optional ones you might consider," says Henry. "Standard coverages include Collision, Other Than Collision, Liability and Medical Payments. They help provide coverage for damage to your ATV itself or damage or injury that you may cause while riding your ATV." 2. Is my safety apparel covered? "Whether it's helmets, goggles or other clothing that helps minimize injuries from an accident, most companies will offer safety apparel coverage for when these things get damaged," says Henry. "We want riders to be as safe as possible while enjoying the outdoors, so we encourage wearing safety gear." 3. Is there optional equipment coverage available? "Most people have customized or added options to their ATVs," Henry explains. "Optional Equipment coverage helps cover things like towable trailers, racks and winch kits for your ATV." 4. Am I able to insure my ATV/UTV year-round? "Year-round coverage is definitely something you may want to consider," answers Henry. "Some policies have a lay-up period for colder weather when you may not be able to ride. But when an unusually warm day comes around and you want to take your ATV out, you might be stuck without coverage. A year-round policy lets you take it out whenever Mother Nature's providing good weather and, with some companies, you can do this for the same price as seasonal coverage." 5. What kinds of discounts are available? "Everybody wants to save money," Henry shares. "Ask what's available for you. Some companies, like Foremost, offer discounts for things like multi-units, multi-policies, maintaining continuous coverage when you renew and for having prior off-road vehicle insurance." Your safety is number one to us. Stay safe wherever you choose to go on your off-road vehicle. Looking for ATV insurance? Get a quote today by calling 561-768-8176 to speak with a licensed agent. Source: https://www.foremost.com/learning-center/top-questions-to-ask-about-off-road-vehicle-insurance.asp As of July 15, 2022, all Southern Fidelity insurance policies are canceled. If you are a former Southern Fidelity Insurance customer, Harris, Reed & Seiferth Insurance Group can help with the transition. Simply call 561-768-8176 for assistance. Below find everything you need to know about this change and how we can help you transition to another policy that meets your needs. Liquidation of Southern Fidelity Insurance Company

On June 15, 2022, Southern Fidelity Insurance Company (“SFIC”) was ordered liquidated by the Second Judicial Circuit Court in Leon County, Florida. The Florida Department of Financial Services (“Department”) is the court appointed Receiver of SFIC. A copy of the liquidation order for SFIC is available on the Department’s website, www.myfloridacfo.com/division/receiver. Please be informed that:

FLORIDA POLICIES: Citizens Property Insurance Corporation (“Citizens”) may be able to offer coverage. Citizens is prepared to write eligible policies if, after a good-faith search, agents cannot find coverage in the private market. Because of hurricane season and the short time between the liquidation of Southern Fidelity and the policy cancellation date, Citizens is working to make this easier. Citizens is prepared to:

Open Claims: If the insured property has unrepaired damage, property owners will need to take steps to repair it, have a contract for repairs, or otherwise demonstrate insurability. Submitted applications unbound for approval must include the following documentation:

Call Us Today For An Affordable, Quality Policy Harris, Reed & Seiferth Insurance Group can help you transition to an affordable, quality insurance policy that meets your needs. Please call us at 561-768-8176 and reference your SFIC policy so that our agents can assist you.  Transitioning from a home where you have roots in one place to a full-time life on the road is a drastic change, but there are many things that draw people to this “nomad” lifestyle. It could be the flexibility, the love of traveling, or maybe you just want to get out of your comfort zone and try something new! Whatever the reason may be, if you’re preparing to be an RV full-timer, kudos for having the courage to embrace this exciting lifestyle change. We know it can be overwhelming to think about the details involved with living full-time in an RV, and your choice to welcome the open road may seem impulsive to others, but that’s okay. Life is short, and who knows … you may end up regretting not doing this sooner! Here are some tips to help you prepare for living in an RV full-time. Become a Minimalist. Adapting a minimalist lifestyle often requires major changes. You’re probably going from a normal-sized home to a roughly 270 square foot space, which forces you to ask: “What do I really need?” To determine this, start by writing down everything you want to bring, then write another list of everything you actually need. This will help you visualize and prioritize your possessions. Bring all the necessities, of course – clothes, toiletries, shoes, cookware, etc. However, you won’t nee d 10 pairs of boots, or the many t-shirts that have been sitting in your drawers for 2+ years, or 20 drinking glasses that you currently have in your kitchen. You may need to make some tough decisions, but take this opportunity to de-clutter your belongings. Make a “take” pile and a “donation” pile. It’s always a good idea, even if you aren’t planning to RV full-time! Go Paperless. Life on the road means you won’t be home to pick up your mail and see if you received any bills. Move all of your bills (cell phone, medical, credit cards, auto insurance, etc.) to automated billing so you don’t need to worry about it. Once you make the switch, you should get all notifications for your bills via email moving forward. Plus, this helps save the environment! Sell or Keep Your Home? This brings us to our next question – will you make the commitment to sell your home and have your RV be your only residence? This depends on how much you plan to travel throughout the year. Also, can you afford to keep your home while traveling? You will still have your mortgage payments, maintenance on the home and other obligations. If you decide to keep your home, there’s always the option of renting it out so you won’t have to worry about any mortgage payments. If you don’t start renting, make sure you have someone regularly stopping by your home to get the mail and take care of any maintenance needed as the seasons go by. If you do decide to sell your home or cancel a lease, you will need to choose a domicile state and receive mail. Getting a domicile means you are choosing a state for your legal residence. This state will be listed on your driver’s license, where you purchase your health insurance, where you can vote and where you will accept mail. (There are lots of mail-forwarding services that will set you up with a street address so you can officially establish residency. This is helpful because a P.O. Box address will not be accepted as your legal residence). The best states for full-time RVer domiciles are Texas, Florida or South Dakota.* People usually choose these states because they are income tax-free! Selling your home will also allow more financial freedom for your RV travels! Get that estate sale ready, or find a storage unit to put all of your furniture in, just in case you ever want a break from the RV life. Determine a Monthly Budget. You may think you’ll be saving a lot of money when you live on the road – but you will be surprised. Since your expenses will be drastically different from when you lived in a home, you need to budget and keep track of everything you spend. Things like campsite fees, eating out frequently, gas and unexpected RV repairs can add up. Once you get a good idea of how much you’re spending each month, you can adjust your budget accordingly. Purchase Full-Time RV Insurance. Since your RV will be your permanent residence, you need a specific type of insurance coverage called “Full-Time RV Insurance.” You will be covered against liabilities, Additional Living Expenses, medical expenses in the case of an accident and more! Contact one of our local agents today to get more information on how you can get covered, so you can enjoy your travels across the U.S., or start an RV quote now! Stay Connected with Family and Friends. Communicate with your friends and family on a regular basis. (They will miss you!) It’s also a good idea to let a few people know your current location and where you’re headed next on a regular basis, just in case of an emergency. To make your loved ones feel like they’re part of your adventure, post pictures frequently on social media or send them via text or email. It will let everyone know you and your companions are safe, and also allows you to stay connected with everyone even when you’re not physically with them. Enjoy Every Minute. Living life on the road is a once-in-a-lifetime experience. You will see amazing things, meet one-of-a-kind people and make the best memories. Don’t take it for granted! With traveling, you will always run into some bumps in the road – but that’s part of the journey. Don’t let it discourage your long-term goals. You’re not tied down to a routine now, so enjoy the freedom and independence that comes with RVing full-time. Stay safe and happy travels from Foremost! Source: https://www.foremost.com/learning-center/a-guide-for-full-time-rv-living.asp

*https://www.moneycrashers.com/rv-living-choose-domicile-state-get-mail/ I can only imagine a few things worse than waking up in the morning and discovering the unexpected – you've been robbed! You may feel violated, and then angry…and then confused. You might think, "Who would do this, and how did it slip right under my nose?" If this has ever happened to you, don't feel bad; it can happen to anyone – at any time. According to the FBI's most recent property crime report, nearly 8 million homes reported property crime offenses in the U.S. in 2016 alone, and that includes neighborhoods where the crime rate is very low. I've rented since college and haven't had an issue with my safety, or experienced a burglary in any of my apartments. I am always careful to lock the front and patio door before going to bed. But, I did slip up recently. I was so exhausted I fell asleep on the couch and forgot to lock the door! Luckily, I woke up in the middle of the night to get water and noticed the door was unlocked. Since I've never lived alone before now, I felt scared and anxious - and immediately locked the door. I couldn't believe I had put myself at risk like that, especially because I consider myself very cautious and aware of my surroundings. After my personal safety lapse, I began to wonder what additional security measures I am allowed to take at my apartment complex. I don't technically own the place, so what can I do besides lock my door? I found out there are security measures I can implement in and outside of my apartment to help ensure my safety – and I wanted to share them with all the fellow renters!

Source: https://www.foremost.com/learning-center/protect-your-apartment-from-breakins.asp

Homes become vacant for many reasons. Maybe your home is for sale but you haven't found a buyer yet. Or you've purchased a new home but won't move in for a while. It could be a rental property that's between tenants. Whatever the cause, there are some insurance risks that you should keep in mind.

You may be thinking, why get vacant home insurance when you already have regular homeowners insurance? Well, most homeowners policies exclude or limit coverage if the home is vacant, so you'll need more specific coverage. Insurance coverage is extremely important for a vacant home, because there are lots of dangers that threaten vacant homes in particular. If you're debating whether or not you need a vacant policy, talk to your insurance agent! Here are some things to ask about: Cost Vacant home insurance typically costs more than regular homeowners insurance due to potential risks like weather threats, fires and vandalism. However, you may be able to get a discount by installing security systems around the house. Even if your insurance company doesn't provide a discount for extra security, it's a good idea that will make your home safer! Coverage Each vacant home insurance policy is different. Many cover damage caused by fires, lightning, wind storms, hail, vandalism and theft. Check with your insurance company to see what options you have. (Remember to ask if flood damage coverage is an option!) There are also different time lengths for policies. Many are 12 months long, but they could go up to four years, so find out what will work best for you. You'll also want to consider Liability coverage, which applies if anyone is hurt on your property and you're found legally responsible. Restrictions Many insurance companies have different definitions of what is vacant and what is unoccupied. Additionally, there may be a specific time length distinction for the type of coverage. Restrictions can also be based on the age or value of the home. Discuss these variables with your insurance agent to find the coverage that works best for you! Still not sure if vacant home insurance is for you? Contact our local agents to learn more and get a quote! Overall, don't be afraid to ask questions about insurance. Let us know if you have any questions in the comments.

What to do if you’ve lost your health care coverage

For those who have lost their job (and therefore their health insurance) because of coronavirus, they are eligible for a special enrollment period (SEP), which involves re-opening the Healthcare.gov enrollment site.

Read more: How to get ACA health insurance if you lose your job Generally, people are only able to obtain health care coverage during open enrollment. However, getting laid off is considered a “qualifying event,” which means the person can sign up for health care coverage outside of open enrollment. Another option is COBRA, which means the individual continues the same health care coverage they had under their employer-based health insurance, though COBRA has higher premium payments since there is no longer an employer contribution. And if income is considered low enough, a person may be eligible for Medicaid. Lastly, don't forget the agency in your back pocket - us! We can help educate you about your options outside of ACA coverage. Just head over to our National General Health E-Store for Health, Dental, Accident, Critical Illness, and Cancer options or our UnitedHealthcare Health E-Store where you'll be able to familiarize yourself with our co-branded health plans designed to meet the needs and budgets of individuals and families. If you feel like nothing there fits or you would simply like to see other options, just let us know and we can send you some additional brochures with other companies. Health, Dental, Cancer, Critical Illness & more...

|

|

National General Access gives you an affordable and predictable way to get health care you need for things such as checkups, prescriptions, lab tests, and more. There are no deductibles or copays to satisfy. This plan pays set dollar amounts when you receive covered services. Any costs that exceed the benefits are the customer's responsibility.

National General Access features:

|

Benefits increase as you go

Select benefits will increase with each consecutive year for up to three years. You can apply at any time during the year and the plan is auto-renewable, so you don’t have to re-enroll. LIFE Association membership This plan is brought to you through LIFE Association, a non-profit, members-only organization that provides you with lifestyle-related perks and discounts on everyday services, as well as additional health programs to help you save. |

Health, Dental including Vision, Teladoc & more...

with UnitedHealthcare

The HealthiestYou telehealth app from Teladoc® offers you access to 24/7 virtual care from a nationwide network of doctors – all for the cost of a monthly membership fee. Now, that access extended to Behavioral Health Care and Dermatology Services!

NEW! Behavioral Health Care – You can receive support for anxiety, depression, eating disorders, family problems, and other issues. Care from a licensed psychiatrist, psychologist, or therapist is available by phone or video 7 days a week.

NEW! Dermatology Services – You can share photos of your skin condition or infection with a board-certified dermatologist and receive a diagnosis and treatment plan within two business days (typically within 8 hours). Free follow-up is included for a week after the session.

Included with Membership – You will still have access to doctors ready to diagnose, treat, and prescribe medication for many of the most common ailments, right over the phone. You can use the app to find a doctor, dentist or other provider in your area, and comparison shop to get the best price on a procedure or prescription.

- Psychiatrist: $200 for initial evaluation & $95 for each ongoing session

- Psychologists or Therapists: $85 per session

NEW! Dermatology Services – You can share photos of your skin condition or infection with a board-certified dermatologist and receive a diagnosis and treatment plan within two business days (typically within 8 hours). Free follow-up is included for a week after the session.

- Dermatologist: $75 per session

Included with Membership – You will still have access to doctors ready to diagnose, treat, and prescribe medication for many of the most common ailments, right over the phone. You can use the app to find a doctor, dentist or other provider in your area, and comparison shop to get the best price on a procedure or prescription.

- Added cost for these services: Nothing! All of this is included with your $20 HealthiestYou membership fee.

Budget-friendly coverage and straight-forward fixed benefits:

|

Health ProtectorGuard is a great way to fill the gaps in coverage, paying fixed benefit amounts for eligible health services, so you can focus more on your care and less on your budget. Coverage includes benefits for doctor visits, pharmacy services, outpatient services, hospital services, surgical services, and wellness/preventive.

Health ProtectorGuard benefits:

|

Designed to add value Along with the wellness, preventive, and increasing injury reimbursement benefits that can help, there is no lifetime maximum benefit! So you may continue to receive benefits up to the limits each year!

Health ProtectorGuard is available at any time of the year. Use this helpful brochure to better understand how this product can help you and your family. |

Golden Rule Insurance Company is the underwriter of UnitedHealthcare insurance plans. National General Accident and Health markets products underwritten by National Health Insurance Company, Integon National Insurance Company, and Integon Indemnity Corporation. Subject to health underwriting. Product availability and designs vary by state.

Harris, Reed & Seiferth Insurance Group, Inc.

6650 W Indiantown Rd

Harris, Reed & Seiferth Insurance Group, Inc.

6650 W Indiantown Rd

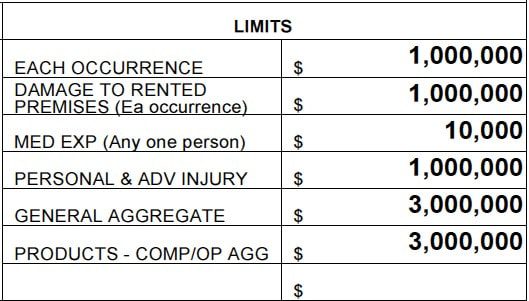

Now and again, it is our recommendation in the insurance industry that businesses carry higher liability limits. So, someone might wonder: “Why is my medical expenses limit so low compared to my other general liability coverages?”

To answer this question, let’s take a look at a standard commercial general liability outline:

To answer this question, let’s take a look at a standard commercial general liability outline:

The answer to why a medical expense limit is so low compared to general liability coverage is twofold—where liability coverage is for situations where a third-party claims your negligence for bodily injury or property damage, medical payments is considered an exception. This is because the coverage pays for bodily injury medical expenses to third parties as a result of your operations regardless of fault.

The idea behind reimbursing others—regardless of fault—for medical or funeral expenses they incur as a result of injury or death on your premises is that people are less likely to sue if they receive timely payment for their medical bills. This also helps to prevent any costly legal fees.

So why wouldn’t we want our medical payments limit to be higher if the intent is to avoid lawsuit expenses and hefty claims?

First, medical expense limits apply separately to each person, and they are a sublimit of the each occurrence limit. Meaning, payments made under this coverage reduces your each occurrence limit as well as your general aggregate limit.

Here’s an example:

You carry a $10,000 medical payment limit, a $1,000,000 per occurrence limit and $1,000,000 general aggregate limit. A customer slips and falls on your wet floor after you neglected to provide adequate warning of it having been mopped. $5,000 in medical expenses are incurred, so your medical expenses coverage pays that cost. The hope is this person is satisfied with you having covered their medical bills, but this is not always the case. This brings us to our second point…

Making a payment under medical payments coverage doesn’t release you of liability from the injured party or prevent them from taking civil action. Continuing our example, the customer decides to sue, and you are now processing a claim under the liability portion of your commercial general liability. The $1,000,000 per occurrence limit of liability you originally carried has now been reduced to $995,000 as a result of medical payments. Your general aggregate has also been reduced to $995,000.

Now, let’s say five individuals slip and fall on your wet floor—each incurring the maximum $10,000 of medical expense payments. Remember, medical expense limits apply separately to each person and are a sublimit to the each occurrence limit. Even before these individuals have decided whether or not to take civil action, the per occurrence and aggregate limit have been reduced by $50,000.

Once you think about this information, the question of “Why is my medical expenses limit so low?” can quickly become, “Is my medical expense limit too high?” If you own a business that has an exposure to third party slip and fall accidents on sidewalks, aisles, staircases, or even elevators, perhaps it’s worth asking whether or not your medical payments coverage is at the right limit. This can help you maintain healthy liability limits in the event that medical payments are not sufficient.

Contact the trusted advisors at Harris, Reed & Seiferth Insurance Group, Inc. if you have any questions.

The idea behind reimbursing others—regardless of fault—for medical or funeral expenses they incur as a result of injury or death on your premises is that people are less likely to sue if they receive timely payment for their medical bills. This also helps to prevent any costly legal fees.

So why wouldn’t we want our medical payments limit to be higher if the intent is to avoid lawsuit expenses and hefty claims?

First, medical expense limits apply separately to each person, and they are a sublimit of the each occurrence limit. Meaning, payments made under this coverage reduces your each occurrence limit as well as your general aggregate limit.

Here’s an example:

You carry a $10,000 medical payment limit, a $1,000,000 per occurrence limit and $1,000,000 general aggregate limit. A customer slips and falls on your wet floor after you neglected to provide adequate warning of it having been mopped. $5,000 in medical expenses are incurred, so your medical expenses coverage pays that cost. The hope is this person is satisfied with you having covered their medical bills, but this is not always the case. This brings us to our second point…

Making a payment under medical payments coverage doesn’t release you of liability from the injured party or prevent them from taking civil action. Continuing our example, the customer decides to sue, and you are now processing a claim under the liability portion of your commercial general liability. The $1,000,000 per occurrence limit of liability you originally carried has now been reduced to $995,000 as a result of medical payments. Your general aggregate has also been reduced to $995,000.

Now, let’s say five individuals slip and fall on your wet floor—each incurring the maximum $10,000 of medical expense payments. Remember, medical expense limits apply separately to each person and are a sublimit to the each occurrence limit. Even before these individuals have decided whether or not to take civil action, the per occurrence and aggregate limit have been reduced by $50,000.

Once you think about this information, the question of “Why is my medical expenses limit so low?” can quickly become, “Is my medical expense limit too high?” If you own a business that has an exposure to third party slip and fall accidents on sidewalks, aisles, staircases, or even elevators, perhaps it’s worth asking whether or not your medical payments coverage is at the right limit. This can help you maintain healthy liability limits in the event that medical payments are not sufficient.

Contact the trusted advisors at Harris, Reed & Seiferth Insurance Group, Inc. if you have any questions.

Categories

All

ATV

Boats

Business

Condo

Dental

FAQs

Financial

Flood

Golf Cart

Health

Home

Insurance

Insurer Liquidation

Life

Local

Mobile Home

Motorcycles

RV's

Safety

Snowmobile

Summer

Trailer

Archives

May 2024

October 2023

July 2023

May 2023

October 2022

September 2022

July 2022

June 2022

March 2022

February 2022

December 2021

October 2021

May 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

September 2020

August 2020

July 2020

May 2020

April 2020

March 2020

February 2020

December 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

December 2018

November 2018

September 2018

May 2018

April 2018

February 2018

November 2017

October 2017

September 2017

August 2017

April 2017

March 2017

Social MediaContact UsNavigation |

|

Website by InsuranceSplash

Privacy Policy | Terms of Use

© 2025 by HARRIS, REED & SEIFERTH INSURANCE GROUP, INC. All rights reserved.

© 2025 by HARRIS, REED & SEIFERTH INSURANCE GROUP, INC. All rights reserved.

RSS Feed

RSS Feed