Harris, Reed & Seiferth

|

Dental implants are commonly used to replace a broken tooth or a tooth with extensive decay that cannot be restored with a root canal or crown. About 1.9 Americans have one or more dental implants each year. Before getting an implant, find out whether it’s the best dental treatment option. Here are five questions to ask your dentist. 1. How will a dental implant benefit my oral health? A dental implant is designed to fill in for a missing tooth and should feel and function like a normal tooth. After a tooth is pulled and the oral tissue heals, an implant screw, made of titanium or other materials, is inserted into the jawbone. Once the screw adheres to the bone, it’s capped with a crown and looks similar to other teeth. Titanium implants, invented over 40 years ago, have significantly improved dental treatments reports the American Dental Association. Previously, dentists replaced a missing tooth with a partial denture or a bridge, designed to look like a tooth, that is attached to neighboring teeth. While both options still are used today, dentures and bridges can be uncomfortable, weaken the jawbone, and require periodic replacement. 2. What happens if a missing tooth is not replaced? When a tooth is lost and not replaced, people may experience difficulty chewing foods, and their jawbone may deteriorate faster, increasing the risk of decay and gum disease and losing neighboring teeth. The remaining teeth may shift, causing bite problems, and the facial skin may sag and create an uneven smile. 3. How long do implants last? Research shows that 95 percent of implants on average have lasted 13 years or more. Implants today are made of newer materials and designed to fit better, so the jawbone heals faster. 4. How much do implants cost? Although implants have become a popular dental treatment, many dental insurance plans do not cover the cost. In some cases, medical insurance may pay some of the expense. Depending on the location and dentist, an implant, crown and related dental work can cost $2,000 to $10,000 or more. Ask the dentist to provide a written treatment plan outlining all of the costs, appointment schedules and follow up checkups. Also, ask about the type of implant used and why it’s the best choice for your needs. 5. What is the dentist’s experience with implants? Before scheduling an implant procedure, find out the dentist’s experience, such as: What is their training with implants? Are they board certified in oral and maxillofacial surgery, periodontics or prosthodontics, or have they received special training? How many patients have they treated with dental implants? Daily tooth brushing and flossing can help prevent the need for dental implants. Read this blog to learn more. Source: https://www.ameritasinsight.com/wellness/dental/dental-implants?_ga=2.172222371.1425065861.1623757121-1035993497.1623278577 American Academy of Implant Dentistry American Dental Association Boston Magazine Medical Xpress

0 Comments

What to do if you’ve lost your health care coverage

For those who have lost their job (and therefore their health insurance) because of coronavirus, they are eligible for a special enrollment period (SEP), which involves re-opening the Healthcare.gov enrollment site.

Read more: How to get ACA health insurance if you lose your job Generally, people are only able to obtain health care coverage during open enrollment. However, getting laid off is considered a “qualifying event,” which means the person can sign up for health care coverage outside of open enrollment. Another option is COBRA, which means the individual continues the same health care coverage they had under their employer-based health insurance, though COBRA has higher premium payments since there is no longer an employer contribution. And if income is considered low enough, a person may be eligible for Medicaid. Lastly, don't forget the agency in your back pocket - us! We can help educate you about your options outside of ACA coverage. Just head over to our National General Health E-Store for Health, Dental, Accident, Critical Illness, and Cancer options or our UnitedHealthcare Health E-Store where you'll be able to familiarize yourself with our co-branded health plans designed to meet the needs and budgets of individuals and families. If you feel like nothing there fits or you would simply like to see other options, just let us know and we can send you some additional brochures with other companies. Health, Dental, Cancer, Critical Illness & more...

|

|

National General Access gives you an affordable and predictable way to get health care you need for things such as checkups, prescriptions, lab tests, and more. There are no deductibles or copays to satisfy. This plan pays set dollar amounts when you receive covered services. Any costs that exceed the benefits are the customer's responsibility.

National General Access features:

|

Benefits increase as you go

Select benefits will increase with each consecutive year for up to three years. You can apply at any time during the year and the plan is auto-renewable, so you don’t have to re-enroll. LIFE Association membership This plan is brought to you through LIFE Association, a non-profit, members-only organization that provides you with lifestyle-related perks and discounts on everyday services, as well as additional health programs to help you save. |

Health, Dental including Vision, Teladoc & more...

with UnitedHealthcare

The HealthiestYou telehealth app from Teladoc® offers you access to 24/7 virtual care from a nationwide network of doctors – all for the cost of a monthly membership fee. Now, that access extended to Behavioral Health Care and Dermatology Services!

NEW! Behavioral Health Care – You can receive support for anxiety, depression, eating disorders, family problems, and other issues. Care from a licensed psychiatrist, psychologist, or therapist is available by phone or video 7 days a week.

NEW! Dermatology Services – You can share photos of your skin condition or infection with a board-certified dermatologist and receive a diagnosis and treatment plan within two business days (typically within 8 hours). Free follow-up is included for a week after the session.

Included with Membership – You will still have access to doctors ready to diagnose, treat, and prescribe medication for many of the most common ailments, right over the phone. You can use the app to find a doctor, dentist or other provider in your area, and comparison shop to get the best price on a procedure or prescription.

- Psychiatrist: $200 for initial evaluation & $95 for each ongoing session

- Psychologists or Therapists: $85 per session

NEW! Dermatology Services – You can share photos of your skin condition or infection with a board-certified dermatologist and receive a diagnosis and treatment plan within two business days (typically within 8 hours). Free follow-up is included for a week after the session.

- Dermatologist: $75 per session

Included with Membership – You will still have access to doctors ready to diagnose, treat, and prescribe medication for many of the most common ailments, right over the phone. You can use the app to find a doctor, dentist or other provider in your area, and comparison shop to get the best price on a procedure or prescription.

- Added cost for these services: Nothing! All of this is included with your $20 HealthiestYou membership fee.

Budget-friendly coverage and straight-forward fixed benefits:

|

Health ProtectorGuard is a great way to fill the gaps in coverage, paying fixed benefit amounts for eligible health services, so you can focus more on your care and less on your budget. Coverage includes benefits for doctor visits, pharmacy services, outpatient services, hospital services, surgical services, and wellness/preventive.

Health ProtectorGuard benefits:

|

Designed to add value Along with the wellness, preventive, and increasing injury reimbursement benefits that can help, there is no lifetime maximum benefit! So you may continue to receive benefits up to the limits each year!

Health ProtectorGuard is available at any time of the year. Use this helpful brochure to better understand how this product can help you and your family. |

Golden Rule Insurance Company is the underwriter of UnitedHealthcare insurance plans. National General Accident and Health markets products underwritten by National Health Insurance Company, Integon National Insurance Company, and Integon Indemnity Corporation. Subject to health underwriting. Product availability and designs vary by state.

Harris, Reed & Seiferth Insurance Group, Inc.

6650 W Indiantown Rd

Harris, Reed & Seiferth Insurance Group, Inc.

6650 W Indiantown Rd

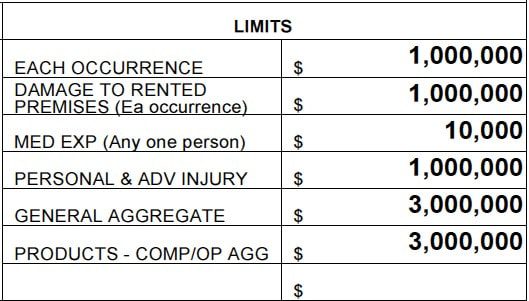

Now and again, it is our recommendation in the insurance industry that businesses carry higher liability limits. So, someone might wonder: “Why is my medical expenses limit so low compared to my other general liability coverages?”

To answer this question, let’s take a look at a standard commercial general liability outline:

To answer this question, let’s take a look at a standard commercial general liability outline:

The answer to why a medical expense limit is so low compared to general liability coverage is twofold—where liability coverage is for situations where a third-party claims your negligence for bodily injury or property damage, medical payments is considered an exception. This is because the coverage pays for bodily injury medical expenses to third parties as a result of your operations regardless of fault.

The idea behind reimbursing others—regardless of fault—for medical or funeral expenses they incur as a result of injury or death on your premises is that people are less likely to sue if they receive timely payment for their medical bills. This also helps to prevent any costly legal fees.

So why wouldn’t we want our medical payments limit to be higher if the intent is to avoid lawsuit expenses and hefty claims?

First, medical expense limits apply separately to each person, and they are a sublimit of the each occurrence limit. Meaning, payments made under this coverage reduces your each occurrence limit as well as your general aggregate limit.

Here’s an example:

You carry a $10,000 medical payment limit, a $1,000,000 per occurrence limit and $1,000,000 general aggregate limit. A customer slips and falls on your wet floor after you neglected to provide adequate warning of it having been mopped. $5,000 in medical expenses are incurred, so your medical expenses coverage pays that cost. The hope is this person is satisfied with you having covered their medical bills, but this is not always the case. This brings us to our second point…

Making a payment under medical payments coverage doesn’t release you of liability from the injured party or prevent them from taking civil action. Continuing our example, the customer decides to sue, and you are now processing a claim under the liability portion of your commercial general liability. The $1,000,000 per occurrence limit of liability you originally carried has now been reduced to $995,000 as a result of medical payments. Your general aggregate has also been reduced to $995,000.

Now, let’s say five individuals slip and fall on your wet floor—each incurring the maximum $10,000 of medical expense payments. Remember, medical expense limits apply separately to each person and are a sublimit to the each occurrence limit. Even before these individuals have decided whether or not to take civil action, the per occurrence and aggregate limit have been reduced by $50,000.

Once you think about this information, the question of “Why is my medical expenses limit so low?” can quickly become, “Is my medical expense limit too high?” If you own a business that has an exposure to third party slip and fall accidents on sidewalks, aisles, staircases, or even elevators, perhaps it’s worth asking whether or not your medical payments coverage is at the right limit. This can help you maintain healthy liability limits in the event that medical payments are not sufficient.

Contact the trusted advisors at Harris, Reed & Seiferth Insurance Group, Inc. if you have any questions.

The idea behind reimbursing others—regardless of fault—for medical or funeral expenses they incur as a result of injury or death on your premises is that people are less likely to sue if they receive timely payment for their medical bills. This also helps to prevent any costly legal fees.

So why wouldn’t we want our medical payments limit to be higher if the intent is to avoid lawsuit expenses and hefty claims?

First, medical expense limits apply separately to each person, and they are a sublimit of the each occurrence limit. Meaning, payments made under this coverage reduces your each occurrence limit as well as your general aggregate limit.

Here’s an example:

You carry a $10,000 medical payment limit, a $1,000,000 per occurrence limit and $1,000,000 general aggregate limit. A customer slips and falls on your wet floor after you neglected to provide adequate warning of it having been mopped. $5,000 in medical expenses are incurred, so your medical expenses coverage pays that cost. The hope is this person is satisfied with you having covered their medical bills, but this is not always the case. This brings us to our second point…

Making a payment under medical payments coverage doesn’t release you of liability from the injured party or prevent them from taking civil action. Continuing our example, the customer decides to sue, and you are now processing a claim under the liability portion of your commercial general liability. The $1,000,000 per occurrence limit of liability you originally carried has now been reduced to $995,000 as a result of medical payments. Your general aggregate has also been reduced to $995,000.

Now, let’s say five individuals slip and fall on your wet floor—each incurring the maximum $10,000 of medical expense payments. Remember, medical expense limits apply separately to each person and are a sublimit to the each occurrence limit. Even before these individuals have decided whether or not to take civil action, the per occurrence and aggregate limit have been reduced by $50,000.

Once you think about this information, the question of “Why is my medical expenses limit so low?” can quickly become, “Is my medical expense limit too high?” If you own a business that has an exposure to third party slip and fall accidents on sidewalks, aisles, staircases, or even elevators, perhaps it’s worth asking whether or not your medical payments coverage is at the right limit. This can help you maintain healthy liability limits in the event that medical payments are not sufficient.

Contact the trusted advisors at Harris, Reed & Seiferth Insurance Group, Inc. if you have any questions.

HealthiestYou is a standard price and includes the whole family -- just $20 per month, making it an affordable option that simplifies care by eliminate the copays and time spent in waiting rooms that come with standard doctors office visits. The HealthiestYou network has doctors licensed in nearly every state, so it's great if travel often inside the country. Included with membership is access to doctors ready to diagnose, treat, and prescribe medication for many of the most common ailments, right over the phone!

HealthiestYou can handle more than 70% of primary care doctor office visits offering:

NEW! Dermatology Services – You can share photos of your skin condition or infection with a board-certified dermatologist and receive a diagnosis and treatment plan within two business days (typically within 8 hours). Free follow-up is included for a week after the session.

HealthiestYou can be a great add-on to insurance products you currently have! Click the button below to get started.

HealthiestYou can handle more than 70% of primary care doctor office visits offering:

- 24/7 access to virtual care from a network of doctors ready to diagnose and prescribe treatment for many common illnesses right over the phone.

- Comparison shopping for prescriptions using a geo-based search engine. This will help you find the best deals on your medication at local pharmacies.

- Behavioral health and dermatology services. Simply pay in the app for these additional features.

- HealthiestYou membership is available to primary member, spouse, and eligible children up to age 18. Membership for children only is not available.

- Psychiatrist: $200 for initial evaluation & $95 for each ongoing session

- Psychologists or Therapists: $85 per session

NEW! Dermatology Services – You can share photos of your skin condition or infection with a board-certified dermatologist and receive a diagnosis and treatment plan within two business days (typically within 8 hours). Free follow-up is included for a week after the session.

- Dermatologist: $75 per session

HealthiestYou can be a great add-on to insurance products you currently have! Click the button below to get started.

Categories

All

ATV

Boats

Business

Condo

Dental

FAQs

Financial

Flood

Golf Cart

Health

Home

Insurance

Insurer Liquidation

Life

Local

Mobile Home

Motorcycles

RV's

Safety

Snowmobile

Summer

Trailer

Archives

May 2024

October 2023

July 2023

May 2023

October 2022

September 2022

July 2022

June 2022

March 2022

February 2022

December 2021

October 2021

May 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

September 2020

August 2020

July 2020

May 2020

April 2020

March 2020

February 2020

December 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

December 2018

November 2018

September 2018

May 2018

April 2018

February 2018

November 2017

October 2017

September 2017

August 2017

April 2017

March 2017

Social MediaContact UsNavigation |

|

Website by InsuranceSplash

Privacy Policy | Terms of Use

© 2025 by HARRIS, REED & SEIFERTH INSURANCE GROUP, INC. All rights reserved.

© 2025 by HARRIS, REED & SEIFERTH INSURANCE GROUP, INC. All rights reserved.

RSS Feed

RSS Feed